Why I Track My Money

It seems obvious, doesn’t it? You keep a ledger of your account transactions, then you reconcile them with the bank’s statement at the end of each month. Simple. Everyone learns this in grade school, right? You do it because you were told to do it. You do it because that’s the way it’s always been.

Maybe in my family. Maybe the Scots and Jews have done this for generations and it’s a cultural heritage thing.

There are many good reasons to keep an account ledger for your checking and credit card accounts. But for me it all boils down to this: money. Yes, not keeping track of my money can cost me money. No, not can: will cost me money. Eventually it’ll happen. Like that one time I made a deposit at an ATM and the bank shorted me $100. I caught it and told them to fix it. They did. Or that other time that my city didn’t email me my water utility bill when they said they’d email it to me every month. I fixed that too. That one saved me a late charge. Or how about all those loan payments? Student, mortgage, or otherwise. There are penalties if you’re late. The answer is obvious: just keep track of shit.

Now I’m not prescient enough to track all my monthly transactions and due dates in my head. I keep more important stuff in there. Especially since I can farm out the simple and mundane duties of tracking things like numbers and dates to some indentured machine. Hmm… what’s good for that? Oh, that’s right: a computer!

I used to use Quicken but they’re bozos when it comes to Macs so I switched to a free program that’s just as good called Gnucash. I’m not selling anything here, it just works for me.

So the bottom line is this, dear reader: if you don’t have a method for tracking your money, find one. NOW. It could be a free computer program, a ledger book from an office supply company, a notepad you keep in a drawer, or even one of those free booklet thingies you get with every new box of checks (what are those for, again?). You don’t have to track absolutely every penny like I do, but for the love of God, at least track your one or two active accounts! Banks screw up. People screw up. I screw up. (Lots of times I mix up numbers and enter a charge incorrectly.) I check them and they check me. It’s a mutually beneficial system. How would you know if someone stole your credit card number if you didn’t reconcile your purchases every month? Sure they have fraud protection but I believe most of their policies make the cardholder an active partner in enforcing that policy, don’t they? Can you really come back six months later and notice you actually didn’t buy that $x00 thingamajig after all? I don’t know, but what I do know is that once they have your money, they are loath to give it back.

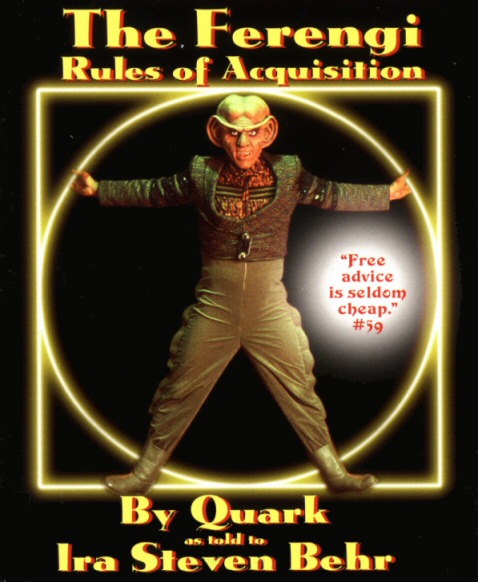

Ferengi rule of acquisition #1:

Once you have their money, you never give it back.